→ Listen on Spotify, Apple, YouTube

Today’s episode is brought to you by, Highbeam.

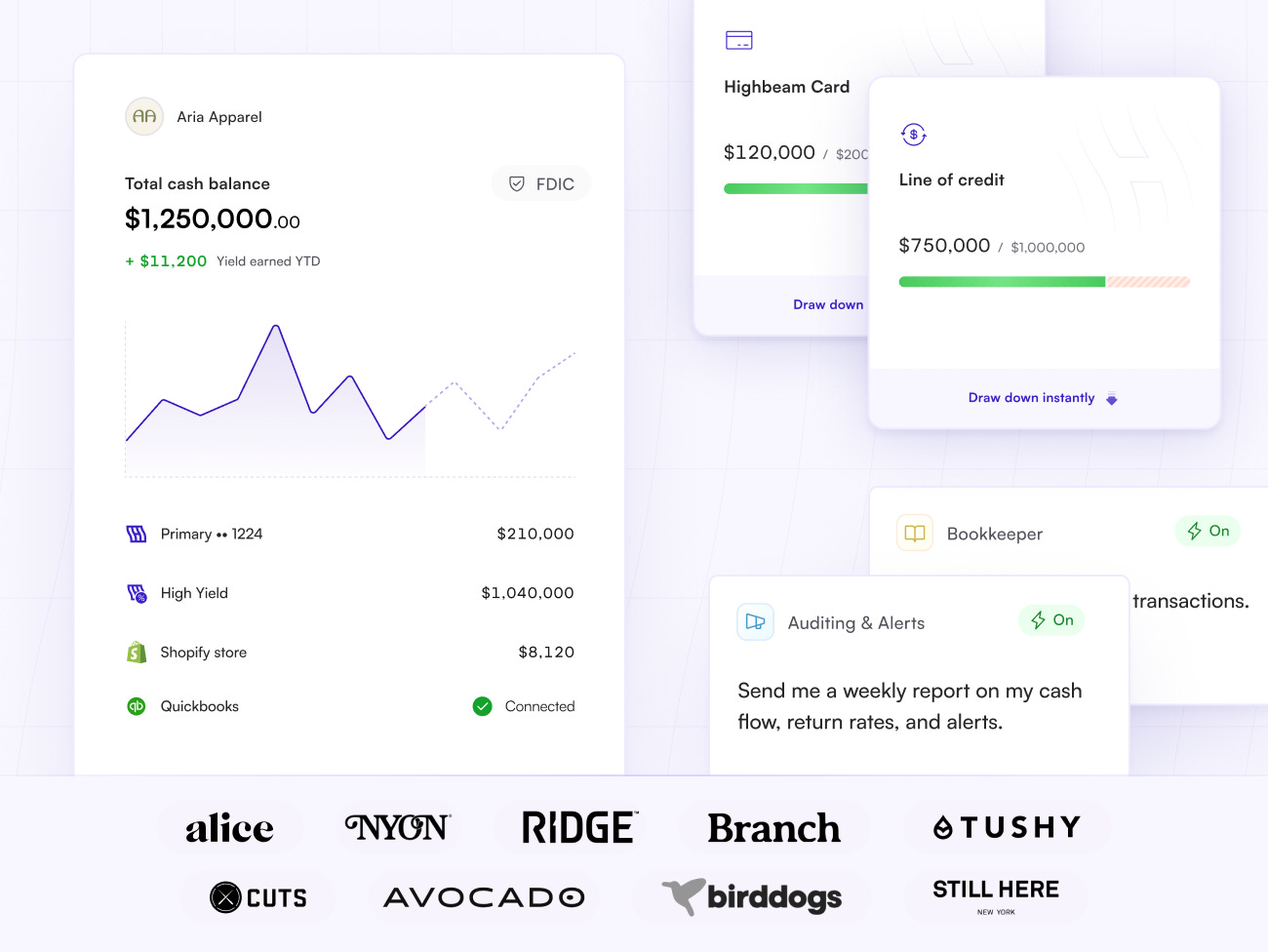

Running a brand? Highbeam is the all-in-one banking and cash management platform built specifically for consumer brands.

It combines no-fee banking, automated treasury to maximize yield on idle cash, flexible credit, bill pay, and live 13 week cash flow — plus AI agents that automate tedious manual spreadsheet work

Think: fast answers to ad hoc sales and finance questions, cash flow forecasting and scenario modeling, benchmarking, and more.

Brands like Birddogs, New York or Nowhere, Ridge, and Avocado use Highbeam to stay ahead of cash flow, make significantly more money on idle cash, and access credit that fits how brands actually operate.

Build your brand. Keep your cash.

Hey friends,

A big thank you to Odile Roujol for introducing me to our guest today—Shamin Walsh, Managing Director at BAM Ventures. BAM is an early-stage, consumer-focused venture capital firm based in Los Angeles that’s focused on investing at the pre-seed stage. They’ve backed some truly iconic companies:

Honey

Cotopaxi

NerdWallet

Zola, Away

Thrive Market

The list goes on. Seriously, some of the most exciting consumer success stories out there.

In this episode, we dig into:

03:44 Why She Joined BAM originally & What Makes the Firm Different

07:00 Is Investing in Consumer Still Sexy? (Hint: Yes, If You Do It Right)

10:07 Power Law Returns in CPG & Brand Exits

13:21 Why Fund Size Dictates Strategy

16:10 Balancing Brand, Commerce Infra & Consumer Tech

17:30 What BAM Looks for in Founders

20:15 Case Study: How Thrive Market Nailed Consumer Behavior

23:15 The Danger of False Signals in Consumer Startups

26:00 How BAM Thinks About Reserves & Follow-Ons

28:20 Staying Price Disciplined (Even in the 2021 Hype Cycle)

30:00 Why Founders Pick BAM Over Bigger Funds

32:00 Capital Efficiency ≠ Always Bootstrapping

35:09 Fundraising Strategy & How to Navigate Future Rounds

37:00 What Early Traction Signals Actually Matter

39:10 How BAM Measures Stickiness vs. Trendiness

44:00 Could a New Social Platform Still Win?

46:00 BAM’s View on AI: Not a Strategy, Just a Tool

48:00 ⚡ Rapid Fire Round: Trends, Products, Books

52:00 Why “The Little Prince” Still Inspires Shamin